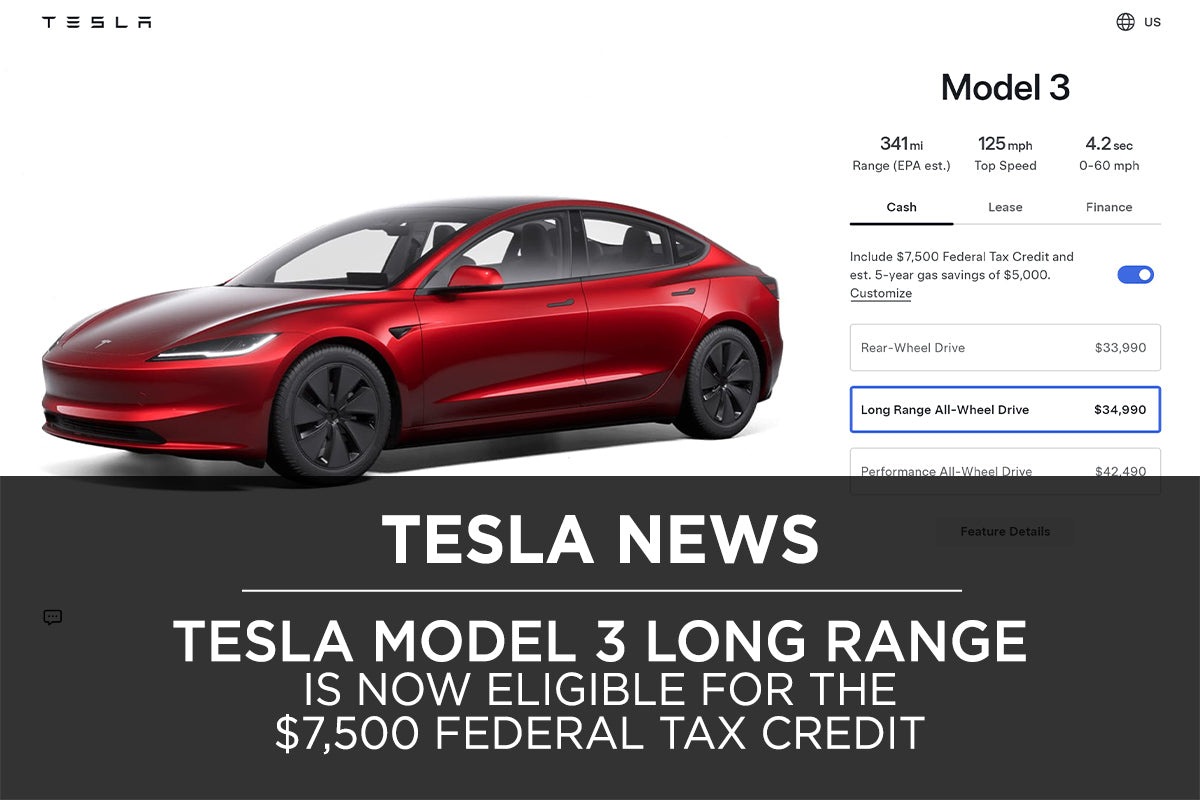

The Tesla Model 3 Long Range is now officially eligible for the $7,500 federal tax credit for electric vehicles.

Due to stricter requirements on battery material and component sourcing, not all electric vehicles qualify for the full $7,500 federal tax credit. This has made it challenging to keep track of which cars are eligible, as automakers work to comply with these standards.

For instance, when Tesla introduced the new Model 3 Performance, we observed that it was more sensible to choose it over the less expensive Model 3 Long Range because it qualified for the tax credit—assuming the buyer met the income eligibility criteria of $150,000 per year for individuals or $300,000 for joint filers. Now, both Tesla and the IRS have confirmed that the Model 3 Long Range also qualifies for the full tax credit along with the Performance model.

After applying the tax credit, the Model 3 Long Range now starts at approximately $40,000—just $1,000 more than the Model 3 Rear-Wheel Drive, which doesn't qualify for the credit due to its use of LFP battery cells from China.

While Tesla hasn't provided specific comments on the changes, it's assumed that the automaker has modified the batteries in the Model 3 Long Range to meet the eligibility requirements for the tax credit.